PAN card has become mandatory whether you work or not. Apart from being used for financial transactions, it also serves as an identity proof.

Permanent Account Number, abbreviated as PAN is a 10-digit unique alphanumeric identity allotted to each taxpayer by the Income Tax Department under the supervision of the Central Board of Direct Taxes in order to track financial transactions and to prevent tax evasion.

You have to fill in the form - Form 49A (or) Form 49AA by visiting this website https://tin.tin.nsdl.com/pan/ for applying for NEW PANs.

Permanent Account Number, abbreviated as PAN is a 10-digit unique alphanumeric identity allotted to each taxpayer by the Income Tax Department under the supervision of the Central Board of Direct Taxes in order to track financial transactions and to prevent tax evasion.

|

| Pan Card |

How to apply for a PAN ?

Step 1 - Opening the Form

You have to fill in the form - Form 49A (or) Form 49AA by visiting this website https://tin.tin.nsdl.com/pan/ for applying for NEW PANs.

|

| PAN Card Application Form |

You will see a page like the above, in there click NEW PAN Form 49A which opens a new window "Application for a New Pan".

|

| PAN card application form |

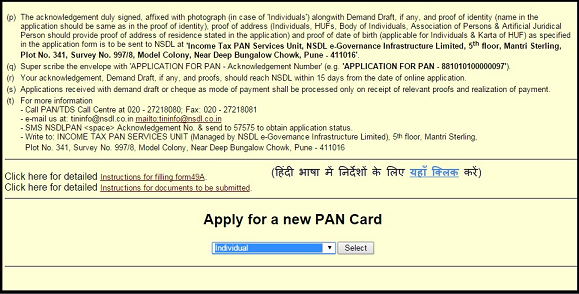

In that click 'Online Application for New PAN (Form 49A)" which again opens a third window. Scroll down till you see 'Apply for a new PAN Card' along with a drop down box 'Category for applicant'.

Choose "Individual" or accordingly for companies or Goverment agencies.

Attach Proof of Identity (POI) - Aadhaar Card issued by the Unique Identification Authority of India,Elector's photo identity card,Driving License,Passport,Ration card having photograph of the applicant,Arm's license,Pensioner card having photograph of the applicant, etc.

Proof of Address (POA) - Electricity Bill, Landline Telephone or Broadband connection bill, Water Bill, Consumer gas connection card or book or piped gas bill, Bank account statement or as per note 2, Depository account statement, Credit card statement, etc.

and Proof of Date of birth (PODB - if applicable) as per Rule 114 (4) of Income Tax Rules, 1962 which have the same name that is written on the application form.

If your paying online, the processing fee can be paid via net banking, credit card or debit card , after which a payment acknowledgement will be displayed. You will need to save and print acknowledgement as well.

|

| PAN Card Application Form |

On selection, you will get the online application form 49A which is to be filled.

|

| PAN Card Application Form |

Step 2 - Filling the form

If you are applying Applying Online -

Fill in the form 49A online using capital letters, attach the required proof of identify and proof of address. A confirmation screen with all the data filled by the applicant will be displayed which can be re-edited if needed and you will need to confirm the same. After confirmation, an acknowledgement with a unique 15-digit acknowledgement number will be displayed which is needed to be saved and printed.

If you are printing the form -

Fill in the form 49A online using capital letters, attach the required proof of identify and proof of address. A confirmation screen with all the data filled by the applicant will be displayed which can be re-edited if needed and you will need to confirm the same. After confirmation, an acknowledgement with a unique 15-digit acknowledgement number will be displayed which is needed to be saved and printed.

If you are printing the form -

Fill the application in block letters in English with black ink.

Paste a recent colour photograph (size 3.5 cm X 2.5 cm).

And provide the signature within the box. If thumb impression, then you should get the thumb impression attested by Magistrate or a Notary Public or a Gazetted Officer, under official seal and stamp.

Paste a recent colour photograph (size 3.5 cm X 2.5 cm).

And provide the signature within the box. If thumb impression, then you should get the thumb impression attested by Magistrate or a Notary Public or a Gazetted Officer, under official seal and stamp.

Step 3 - Copies of proof of Identity and Address

Attach Proof of Identity (POI) - Aadhaar Card issued by the Unique Identification Authority of India,Elector's photo identity card,Driving License,Passport,Ration card having photograph of the applicant,Arm's license,Pensioner card having photograph of the applicant, etc.

Proof of Address (POA) - Electricity Bill, Landline Telephone or Broadband connection bill, Water Bill, Consumer gas connection card or book or piped gas bill, Bank account statement or as per note 2, Depository account statement, Credit card statement, etc.

and Proof of Date of birth (PODB - if applicable) as per Rule 114 (4) of Income Tax Rules, 1962 which have the same name that is written on the application form.

Step 4 - Processing Fees

Payment can be made through Demand Draft, Cheque or Credit card / Debit card or Net Banking. Fee for processing PAN application: 105 (

105 ( 93 + service tax) for PAN card to be dispatched in India. For dispatch outside India, fee is

93 + service tax) for PAN card to be dispatched in India. For dispatch outside India, fee is 971 (including service tax).

971 (including service tax).

105 (

105 ( 93 + service tax) for PAN card to be dispatched in India. For dispatch outside India, fee is

93 + service tax) for PAN card to be dispatched in India. For dispatch outside India, fee is 971 (including service tax).

971 (including service tax).

Cheque (payable at par)/Demand Draft should be in favour of 'NSDL-PAN' payable at Mumbai and acknowledgment number should be mentioned on the reverse of the Cheque/ Demand Draft.

Step 5 - Submission of Documents

The acknowledgment duly signed, affixed with photograph (in case of 'Individuals') along with Demand Draft, if any, and proof of identity, proof of address and proof of date of birth should be sent at the below address :

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune - 411016

in a envelope superscribed with 'APPLICATION FOR PAN - Acknowledgement Number' (e.g. 'APPLICATION FOR PAN - 8XXXXXXXXXXXXXX').

Note: The acknowledgement, Demand Draft or any thing else should reach NSDL within 15 days from the date of online application. You can track the status of your application online by using the "Status Track for PAN application".

SEE instructions for filling in the FORM 49A of PAN Card Application - Click here for Instructions

Original Source : Income Tax PAN Services Unit

Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune - 411016

in a envelope superscribed with 'APPLICATION FOR PAN - Acknowledgement Number' (e.g. 'APPLICATION FOR PAN - 8XXXXXXXXXXXXXX').

Note: The acknowledgement, Demand Draft or any thing else should reach NSDL within 15 days from the date of online application. You can track the status of your application online by using the "Status Track for PAN application".

SEE instructions for filling in the FORM 49A of PAN Card Application - Click here for Instructions

Original Source : Income Tax PAN Services Unit

home

home

Home

Home